Sustainable Commercial-Scale Aquaculture

Business Model Description

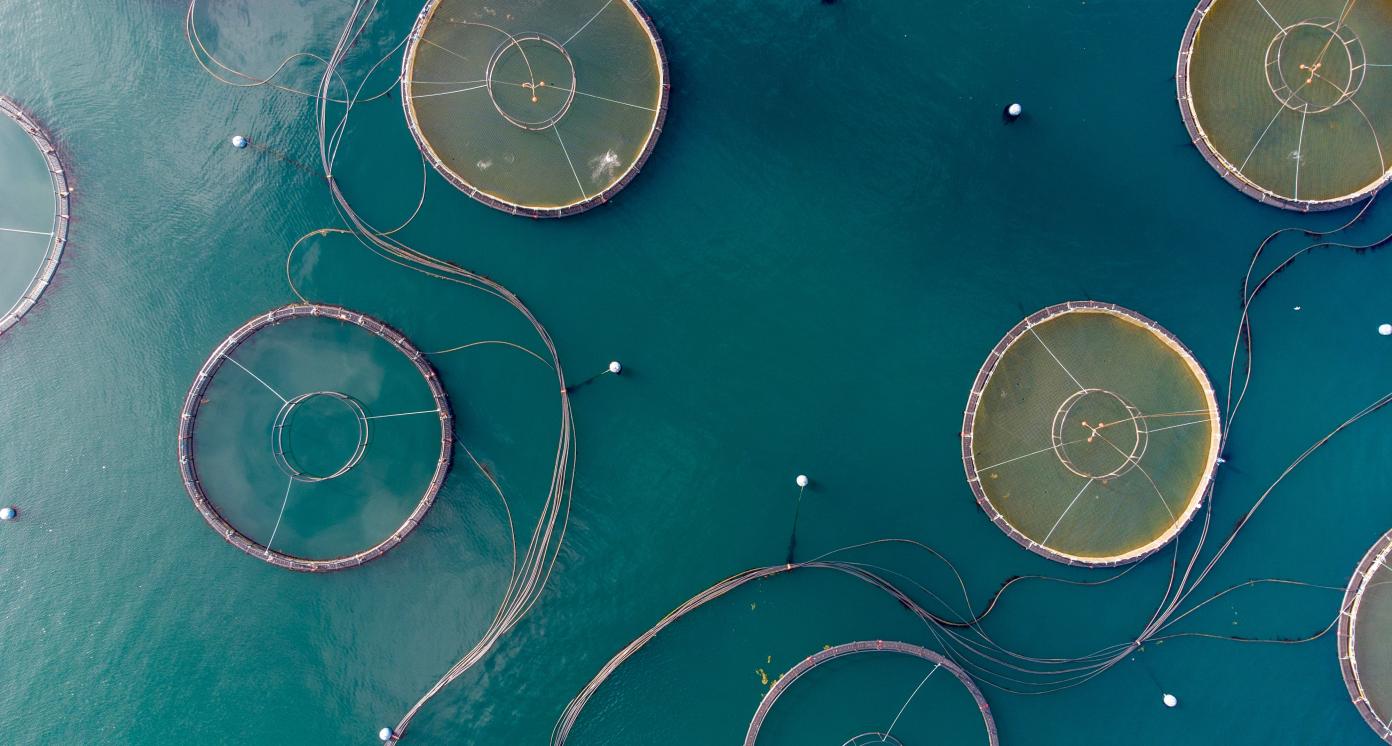

Invest in commercial-scale aquaculture to improve value added production in the fisheries sector and reduce waste generated through post-harvest losses.

The aquaculture industry in Sri Lanka was launched in the early 1980s, with investment from large and mid-scale multinational companies. Activities in this space were highly concentrated in shrimp farming in the mangroves, salt marshes, and brackish water areas. In 2018, the country had ~1400 shrimp farms and 70 hatcheries (17) Examples of companies active in the IOA space:

Oceanpick founded in 2011 is Sri Lanka’s first offshore oceanic farm for finfish, rearing in pristine waters off the northeast shores. It focuses on “responsible farming” that is highly sustainable, producing high-quality seafood, while offering food security and tractability throughout the supply chain. (3)

Taprobane Seafood, established in 2010, is a USD 100 million dollar company. The company has 16 processing facilities, employing over 2,000 direct employees throughout the Northwestern and Northern Provinces. Taprobane Seafood Group is also one of Sri Lanka’s largest export groups, pioneering in raw, processed and value-added seafood exports (5). In 2021, Atman Group made a strategic investment to facilitate Taprobane's growth.

Aqua Hatcheries Lanka (now known as Aqua ‘N Green Ltd) was incorporated in 1991 and is a supplier of post larvae to farmers and has transformed into one of Sri Lanka's most technologically advanced organizations by initiating marine fish breeding and farming, and introducing environmentally sustainable farming models (4) It was part of Integrated Aquaculture Project (2010-2013) by USAID for Sea bass farming in Trincomalee.

Expected Impact

Commercial scale aquaculture to improve livelihoods with higher revenue through ensuring more products, diversification and local value addition.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Sri Lanka: Northern Province

- Sri Lanka: North Western Province

- Sri Lanka: Eastern Province

Sector Classification

Food and Beverage

Development need

In 2021, Agriculture was 7.3% of GDP (1), contributing to 21.8% of Goods Exports and employing 27% of the Labor Force (2). With the present (2022) economic crisis, livelihoods have been under threat, and as a result, have caused a food security crisis leading to malnutrition concerns that could reverse gains seen in development indicators.

Policy priority

National Nutrition Policy (2010); focuses on ensuring food and nutrition security for all citizens (6). Food Production National Program 2016–2018; focus on crop production and productivity. National Export Strategy 2018-22; lists out objectives of efficient trade and logistic hub. All these policies were designed to achieve national and SDG targets.

Gender inequalities and marginalization issues

Low-income households have food security concerns due to high food prices and a drop in agricultural production. UNICEF’s April 2022 national survey showed that 70% of households have reduced their food consumption. Households relying on unskilled labour, fishing or livestock are more at risk while estate and urban poor, are considered disproportionately affected.

Investment opportunities introduction

The changing economic status of the country with expanding urbanization process provides the opportunity to increase the number of food manufacturing units, especially in and around major agricultural areas. A study done by the National Aquaculture Development Authority (19) revealed that over 8,500 hectares in Sri Lanka can be developed into aquaculture but only 25% of these have been used.

Key bottlenecks introduction

Key challenges include limited supply chain facilities, access to capital and input, and lack of cold storage facilities with multi-user facilities. There is low productivity in the sector with a majority of land ownership by the government. The ad hoc decision to change to organic fertilizer (which was subsequently changed) has also disrupted the food production and output of farmers.

Food and Agriculture

Development need

The seafood industry in Sri Lanka has an international reputation owing to its unique properties such as texture, taste, colour. The short supply of exportable grade fish, drives up prices and also leads to less local value addition, and diversification, beyond Tuna. Aquaculture can help bring this diversification and more local value addition. 40-60% of the catch ends up as post-harvest losses (9)

Policy priority

Fisheries Sector Development Strategy 2010-2013: covers food security and increasing non-traditional products through aquaculture (7) National Fisheries and Aquaculture Policy, 2018(draft) lists nine objectives, which include increased aquaculture and inland fisheries production; minimized postharvest losses and increased value addition; increased per capita consumption of fish; increased export earnings(13)

Gender inequalities and marginalization issues

The Aquaculture sector, particularly the shrimp processing industry, employs a majority of female employees. According to stakeholders, this is because females tend to do a cleaner and neater job in shrimp processing than males. However, aquaculture products like Shrimp and crabs, tend to be prone to various diseases directly impacting the incomes of women who are involved in the processing industry.

Investment opportunities introduction

There are only a few players with commercial-scale aquaculture, including a few shrimp farmers. Hence, there is potential for more players to enter the Aquaculture industry, given the conditions for developing commercial aquaculture are optimal in Sri Lanka with both freshwater and brackish/marine water resources.

Key bottlenecks introduction

Aquaculture products are prone to disease outbreak. Therefore, selecting a species with a stronger immune system, better farm management, cleaning systems are needed. Stringent regulations such as environment regulations and license to manage Aquaculture venture, too exist. Imported fish feed takes about 40-50% of the margin.

Processed Foods

Pipeline Opportunity

Sustainable Commercial-Scale Aquaculture

Invest in commercial-scale aquaculture to improve value added production in the fisheries sector and reduce waste generated through post-harvest losses.

The aquaculture industry in Sri Lanka was launched in the early 1980s, with investment from large and mid-scale multinational companies. Activities in this space were highly concentrated in shrimp farming in the mangroves, salt marshes, and brackish water areas. In 2018, the country had ~1400 shrimp farms and 70 hatcheries (17) Examples of companies active in the IOA space:

Oceanpick founded in 2011 is Sri Lanka’s first offshore oceanic farm for finfish, rearing in pristine waters off the northeast shores. It focuses on “responsible farming” that is highly sustainable, producing high-quality seafood, while offering food security and tractability throughout the supply chain. (3)

Taprobane Seafood, established in 2010, is a USD 100 million dollar company. The company has 16 processing facilities, employing over 2,000 direct employees throughout the Northwestern and Northern Provinces. Taprobane Seafood Group is also one of Sri Lanka’s largest export groups, pioneering in raw, processed and value-added seafood exports (5). In 2021, Atman Group made a strategic investment to facilitate Taprobane's growth.

Aqua Hatcheries Lanka (now known as Aqua ‘N Green Ltd) was incorporated in 1991 and is a supplier of post larvae to farmers and has transformed into one of Sri Lanka's most technologically advanced organizations by initiating marine fish breeding and farming, and introducing environmentally sustainable farming models (4) It was part of Integrated Aquaculture Project (2010-2013) by USAID for Sea bass farming in Trincomalee.

Business Case

Market Size and Environment

> USD 1 billion

5% - 10%

USD 3 bn seafood exports by 2025 are expected by the Seafood Exporters' Association with aquaculture products such as shrimp contributing over 65% of this export earnings with others aquaculture products such as crab and sea cucumber tailing. The target production of Shrimp in 2025 is 100,000 MT, i.e. 1.47% of world production, at a 5.4% CAGR (2021-25) according to Seafood Exporters' Association of Sri Lanka

Investigations done by the National Aquaculture Development Authority (NAQDA) (19) revealed that over 8,500 ha in Sri Lanka can be developed into aquaculture. At present only 25% of these areas are used for aquaculture of various species, and feasibility studies have documented that aquaculture can be undertaken in these areas with reduced biological risks (4)

There are also potential land areas such as Lagoons & Estuaries - 158,000 ha, Mangrove Zones, Mud Flats & Salt Marshes - 71,000 ha and total Extent of Fresh Water Bodies - 260,000 ha identified by Ministry of Fisheries (15)

Indicative Return

Ranges between 15 – 40% depending on the species/ technology/quality of feed/land cost

> 25%

Cost of produce: Vannamei shrimp USD 1.7 (LKR 600) per Kg, Black Tiger Shrimp USD 2.24 (LKR 800) per Kg Farming capacity: Vannamei 12 -15 tons acre per pond, Black Tiger 3 tons per 1 acre pond

Return are dependent on key factors. According to stakeholders, these key factors that determine returns are - >Brood stock: the quality would affect the survival and harvest; >Type of species (Vannamei shrimp the yield is 4 times higher than black tiger); >Technology and control environment; >Quality of feed; >Land cost (cost of acquiring land i.e. lease, outright purchase cost)

Investment Timeframe

Short Term (0–5 years)

According to industry stakeholders the payback period is between 2 to 5 years

According to stakeholder input, a large-scale marine fish farm had a 4 year tax holiday. Depending on investment this could even be 5 years. (7) This can act as basis for investment timeframe justification given that the these were based on government assessments to make the investment viable.

Ticket Size

> USD 10 million

Market Risks & Scale Obstacles

Market - Highly Regulated

Business - Supply Chain Constraints

Capital - CapEx Intensive

Impact Case

Sustainable Development Need

Increase food security through value addition and promote sustainable food consumption with balanced nutrition.

Total direct and indirect, part- or full-time jobs in the sector are approximately at 0.9 million, thereby supporting the livelihood of ~3.6 million people, or 17% of the population. Therefore, this is a vital sector which can contribute immensely to the livelohood of the people and economy (13)

The sector contributes about 1.3% of the country’s Gross Domestic Product (GDP) and accounts for 1.5% of total export earnings (14). Therefore, bringing in more exportable quality fish supply, local value addition and diversification through aquaculture can help improve the export sector.

Gender & Marginalisation

Investments in this space are required to create job opportunities for women as women are demanded for aquaculture products such as shrimp by improving local value addition activities and skill development through capacity building measures.

Fish account for around 50% of animal protein and 11% of all protein consumption in Sri Lanka, which is significantly higher than the global averages (12) Thus, increasing fish supply through aquaculture, increases the protein (or nurtrition) uptake by the domestic population, contributing to addressing the food security gap in the country.

Expected Development Outcome

Diversify seafood products and thereby exports, bringing in more local value addition and creating more employment opportunities, particularly for women.

Gender & Marginalisation

Increase national average of protein consumption by producing affordable fish and ensuring food security.

More job opportunities, especially for women, since aquaculture products such as shrimp and crabs employ more women as they tend to do a cleaner job than males.

Primary SDGs addressed

14.4.1 Proportion of fish stocks within biologically sustainable levels

Inland and Aquaculture Fish Production 104,450 MT in 2021 (10)

Shrimp target production in 2025 is 100,000 MT which is 1.47% of world production according to the Seafood Exporters Association of Sri Lanka.

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Indirectly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Outcome Risks

Outcome would be affected by regulatory barriers such as obtaining licenses for aquaculture management, which should be renewed every year(7) This can be a cumbersome process

No duty exemptions are available for feed cost, which accounts for 60% of the production costs in marine fish farms, and is, thus, the most important economic input factor (7)

Gender inequality and/or marginalization risk: The fisheries community (wild caught fish) may lose their jobs. However, more women will get formal job opportunities, which were not present before

Impact Risks

Conditions for commercial aquaculture are optimal as both, freshwater and brackish/marine water, are available in Sri Lanka. Not developing this area will result in underutilisation of resources.(8)

Absence of this IOA will result in lost job opportunities, especially for women, who are a preferred workforce for aquaculture products such as shrimp and crabs.

Aquaculture can increase fish production and reduce wastage. This can increase daily protein uptake and increase affordability of fish. Hence, not investing in this area can have detrimental effects.

Gender inequality and/or marginalization risk: Aquaculture products demand women as they tend to do a cleaner job than men. Lack of aquaculture ventures would mean a loss in these opportunities.

Impact Classification

What

Diversifying export products, more local value addition leading to more exports, employment creation while also reducing the post harvest losses created through the fish catch

Who

More employment opportunities for women; food security and affordable prices for fish can help in increasing the nations nutrition intake.

Risk

Many regulatory barriers, particularly for obtaining license for aquaculture management which needs to be renewed each year. Price for imported feed are high, without any duty exemptions (7)

Contribution

90% of seafood are caught wild of which 40-60% ends up as post-harvest losses and 5% of the fish are exportable. Aquaculture can increase production for exports and domestic consumption.

How Much

According to the World Bank 900,000 people are directly or in directly involved in the fisheries sector supporting the livelihoods of about 17% of the population.

Impact Thesis

Commercial scale aquaculture to improve livelihoods with higher revenue through ensuring more products, diversification and local value addition.

Enabling Environment

Policy Environment

The Fisheries and Aquatic Resources Act (1996) addresses the management, regulation, conservation and development of fisheries and aquatic resources in Sri Lanka. Part VI of the Act addresses aquaculture (21)

The National Aquaculture Development Authority was established under the National Aquaculture Development Authority of Sri Lanka Act (1998). The Authority has general policy responsibility for the development of the aquaculture sector in Sri Lanka (21)

Ministry of Fisheries, Fisheries Sector Development Strategy 2010-2013, strategies related to aquaculture; food security; diversifying to products such as seaweed, seabass, sea cucumber, oyster/mussels for the purpose of export (7)

Financial Environment

There have been cases where BOI has granted tax holidays for 4 years (7)

Fisheries sector was proposed to be exempt from income tax in Budget 2021 (16)

Regulatory Environment

The Fish Product (Export) Regulations of 1998 and Aquaculture (Monitoring of Residues) Regulations of 2000 require inspection and certification of compliance to these regulations by the licensee for each export consignment (21)

Marine Pollution Prevention Act, No. 35 of 2008 and the Marine Environmental Protection: (issuance of permits for dumping at sea) there are provisions for charging tax for a permit to discharge effluent from aquaculture (7)

Product and aquaculture specific regulations; Spiny Lobster and Prawn (Shrimp) Regulations, 1973;The Aquaculture Management Regulations of 1996;The Fishing (Import and Export) Regulations, 2010 amendment 2013; The Inland Fishing Operations Regulations, 2011 (7)

Getting the marine aquaculture farm approvals from Ministry of Environment involves filing separate applications to three different departments in the Ministry: Central Environmental Authority; Coastal Conservation Department and Marine Environment Protection Authority (7)

NAQDA Act provisions to issue the inland fisheries license; the inland culture based fisheries license and the aquaculture management license and has to renewed every year (7)

Marketplace Participants

Private Sector

Oceanpick; Taprobane; Aqua N’ Green Ltd; Atman group; Akbar Brothers

Government

Ministry of Fisheries, the National Aquatic Resources Research and Development Agency (NARA) and the National Aquaculture Development Authority (NAQDA)

Multilaterals

FAO; USAID; ADB; World Bank; Market Development Facility (MDF)

Non-Profit

Sri Lanka Seafood Exporters Association

Target Locations

Sri Lanka: Northern Province

Sri Lanka: North Western Province

Sri Lanka: Eastern Province

References

- (1) Department of Census and Statistics (2022). National Account 2015 Base. http://www.statistics.gov.lk/NationalAccounts/StaticalInformation/2015/Reports/Annual_A49/GDP_co_2010-2021

- (2) Department of Census and Statistics (2022). Quarterly Report of the Sri Lanka Labor Force Survey - Second Quarter 2021. http://www.statistics.gov.lk/LabourForce/StaticalInformation/QuarterlyReports/2ndQuarter2021

- (3) About Oceanpick - https://www.oceanpick.com/about-us/

- (4) Aquaculture in Sri Lanka -https://norwegian-lobster-farm.com/wp-content/uploads/2013/08/AQUACULTURE-IN-SRI-LANKA1.pdf

- (5) About Taprobane - https://taprobaneseafoods.com/about-us/ "6) National Nutrition Policy (2010)- https://extranet.who.int/nutrition/gina/sites/default/filesstore/LKA%202010%20Sri%20Lanka%20National%20Nutrition%20Policy-English_0.pdf

- (7) A Study on Sri Lanka's readiness to attract investors in Aquaculture - http://naqda.gov.lk/pdf/Investment-report-final-2017.pdf

- (8) FAO Country Profile - https://www.fao.org/fishery/en/facp/lka?lang=en

- (9) NARA post harvest losses -http://www.colombopage.com/archive_18A/Feb26_1519620054CH.php#:~:text=According%20to%20research%20done%20by,even%20to%20make%20dry%20fish.

- (10) NAQDA Fish production statistics - http://www.naqda.gov.lk/statistics/

- (11) Towards Improved Livelihoods and Higher Revenues From Sustainable Fisheries in Sri Lanka World Bank -https://www.worldbank.org/en/news/feature/2022/03/02/towards-improved-livelihoods-higher-revenues-from-sustainable-fisheries-srilanka

- (12) Norway and FAO to strengthen fisheries sector in Sri Lanka through responsible use of fisheries and aquaculture resources - https://www.fao.org/srilanka/news/detail-events/en/c/1530018/

- (13) Priorities for Sustainably Managing Sri Lanka’s Marine Fisheries, Coastal Aquaculture, and the Ecosystems That Support Them, World Bank, 2021 - https://openknowledge.worldbank.org/bitstream/handle/10986/36503/Priorities-for-Sustainably-Managing-Sri-Lanka-s-Marine-Fisheries-Coastal-Aquaculture-and-the-Ecosystems-that-Support-Them.pdf?sequence=5&isAllowed=y

- (14) Minsitry of Fisheries - Fisheries in Sri Lanka - https://www.fisheries.gov.lk/web/index.php?option=com_content&view=article&id=64&Itemid=174&lang=en

- (15) Fisheries Statistics - 2021 Ministry of Fisheries -https://www.fisheries.gov.lk/web/images/statistics/annual_report/Fisheries_Statistics_-2021_compressed.pdf

- (16) Income tax exemptions proposed for fisheries -https://island.lk/five-year-income-tax-exemptions-for-agriculture-livestock-and-fisheries-sectors/

- (17) Open Ocean Aquaculture in Sri Lanka- EDB- https://www.srilankabusiness.com/blog/open-ocean-aquaculture-in-sri-lanka.html

- (18) Central Bank of Sri Lanka (2022). Annual Report 2021.https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/annual_report/2021/en/9_Chapter_05.pdf

- (19) Drengstig A, Bergheim A, Braaten B, Jenssen JE, Sandvik A (2003) Feasibility study for full-scale implementation of new shrimp farming technology under commercial conditions in Sri Lanka

- (20) Shrimp aquaculture as a vehicle for Climate Compatible Development in Sri Lanka. The case of Puttalam Lagoon, 2015 - https://www.sciencedirect.com/science/article/abs/pii/S0308597X15002225

- (21) National Aquaculture Sector Overview Sri Lanka - https://www.fao.org/fishery/en/countrysector/lk/en?lang=en

- (22) Shrimp farming: A multi-billion dollar industry, 2022 -https://www.sundayobserver.lk/2022/03/06/impact/multi-billion-dollar-industry